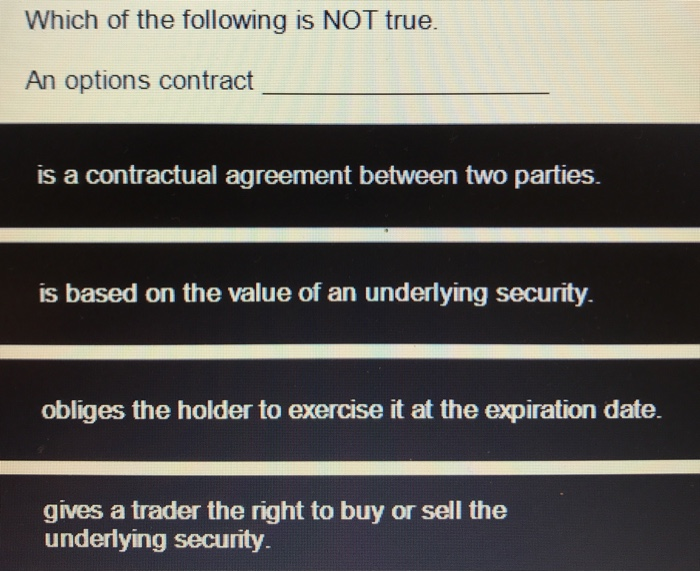

Which of the Following Is Not True. An Options Contract

CDelivery or final cash settlement usually takes place with forward contracts. A Warranty B Condition.

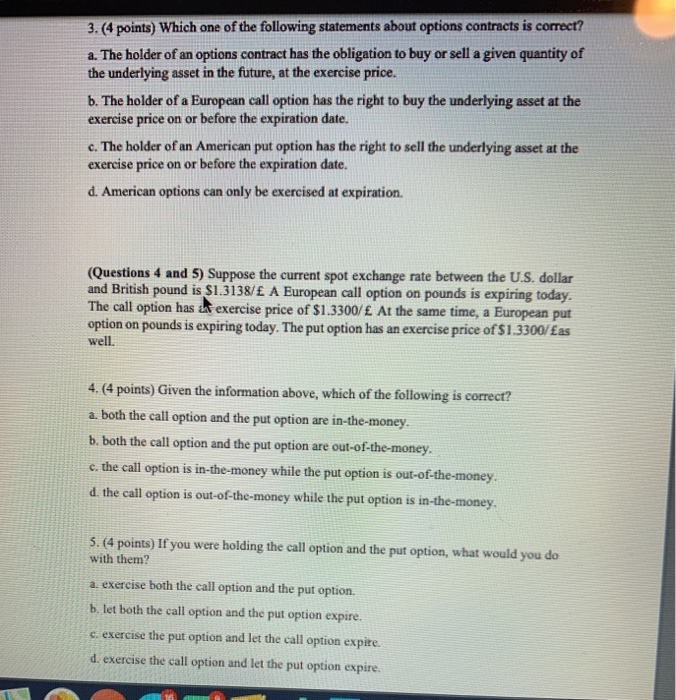

Solved 3 4 Points Which One Of The Following Statements Chegg Com

Which of the following is NOT true about call and put options.

. Which of the following is NOT true. The buyer of a call option has the right to buy the currency at the strike pose b. The price of a call option increases as the strike price increases E.

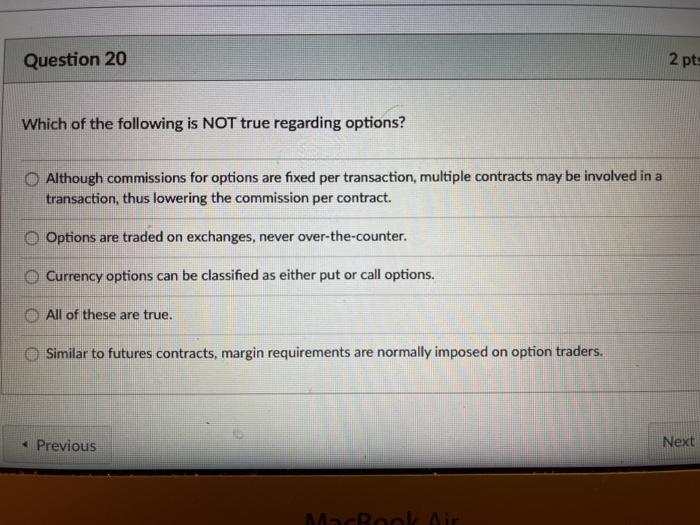

Which of the following is NOT true regarding options a. An options contract is an agreement between two parties to facilitate a potential transaction involving an asset at a preset price and date. The buyer of a put option has the right to sell the currency at the strike price.

When a contract is entered into without the free consent of the party it is considered a voidable contract. The holder of a call or put option must exercise the right to sell or buy an asset D. A A call option gives the holder the right to buy an asset by a certain date for a certain price.

B the option money is usually forfeited if the purchase is not completed C the optionee must sign the contract. Most index-options are European style including the SPTSX 60 Index options. Which of the following is NOT true regarding options.

A the optionee can enforce the sale. Total loss 300 100 x. Stock-index options are available on the SPTSX 60 and various ETFs.

Which of the following is NOT true of options. When a CBOE call option on IBM is exercised IBM issues more stock. Thus there will be a cash outflow of 3 per option.

The definition of the act states that a voidable contract is enforceable by law at the option of one or more parties but not at option of the other parties. Insurance company agrees to safeguards the insured to put him in the same position that heshe would have been in if the loss had not occurred. B A put option gives the holder the right to sell an asset by a certain date for a certain price.

Fire insurance contracts runs on the principle of indemnity. An American option can be exercised at any time during its life. All of the following are true concerning an option contract EXCEPT.

A European option can only be exercised only on the maturity date CInvestors must pay an upfront price the option premium for an option contract DThe price of a call option increases as the strike price increases. A European option can only be exercised only on the maturity date C. If the contract is for 100 options.

The same is not true of futures contracts. BFutures contracts are standardized. A contract in which a landowner gives a developer for a stated consideration the right to buy a parcel of land within a specified time for a fixed price may properly be described as.

The writer of a call option has the obligation to sell the currency to the buyer if the option is exercised. An agreement to sell is an executory contract. D The holder of a forward contract is obligated to buy or sell an asset.

AAn American option can be exercised at any time during its life B. A put option gives the holder the right to sell an asset by a certain date for a certain price C. An American option can be exercised at any time during its life B.

Which of the following is NOT true about call and put options. AFutures contracts nearly always last longer than forward contracts. The writer of a call option has the obligation to sell the currency to the buyer if the option if exercised.

An call option will always be exercised at maturity if the underlying asset price is. The buyer of a call option has the right to buy the currency at the strike price. Which of the following is a bailment plus agreement to sell.

A stipulation essential to the main purpose of the contract is -----. If a stocks price were to rise within a short timeframe a call option would likely provide a greater return than a margin trade. Forward contracts are not.

C The holder of a call or put option must exercise the right to sell or buy an asset. In Canada stock-index options trade. Which of the following is NOT true A.

With options you are insured so to speak against missing out on a. Asked Sep 8 2019 in Business by Jeff54 accounting-and-taxation. A call option gives the holder the right to buy an asset by a certain date for a certain price B.

D the optionor cannot require specific performance. Investors must pay an upfront price the option premium for an option contract D. Which of the following is NOT true.

Therefore net loss 3 5-2. Call options can be purchased as a leveraged bet on the. A Pledge B Hire purchase C Mortgage D None of the above 35.

An attractive feature of owning an option is that you can sell it before expiration. Which of the following is not true concerning stock-index options. A recorded option in a contract by which the owner of property gives another person the right to purchase his property for a stated sum.

DForward contracts usually have one specified delivery date. However the trader has received the option price of 2. Since the trader has written the call option it represents a loss for the trader of 25-20 5.

Fire Insurance is a contract where one party agrees to indemnify the loss of other party at the time of loss for a consideration. Stock-index options enable investors to trade on general stock market movements. Q24 If the actual Gas used in a Contract execution is less than the Gas specified by the user the additional amount is returned.

The statement is A True B False C Depends D None of the above 34. Under the new revenue recognition guidance in ASC Topic 606 which of the following statements is true regarding contracts with customer options.

Solved Question 20 2 Pts Which Of The Following Is Not True Chegg Com

Solved Which Of The Following Is Not True An Options Chegg Com

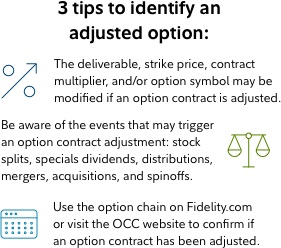

Option Contract Adjustments Fidelity

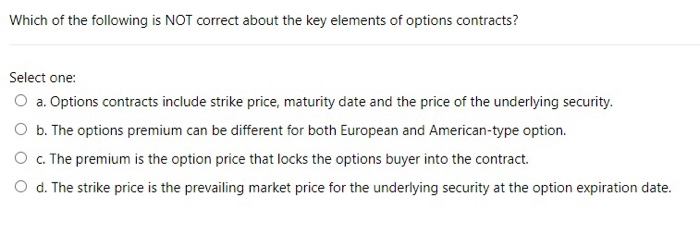

Solved Which Of The Following Is Not Correct About The Key Chegg Com

Comments

Post a Comment